Open Return Preferences

Open Return Preferences affect the view you see when you open a form or return in Payroll. These preferences also determine system behaviors with forms such as Use ALL CAPS for data entry.

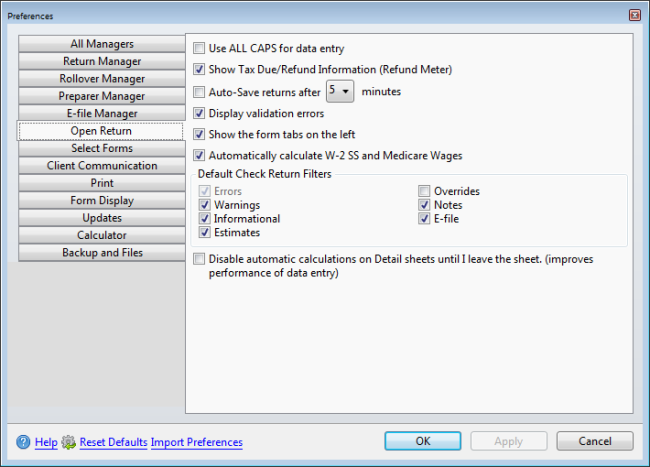

Preferences dialog box (Open Return tab)

The following preference settings are found on the Open Return tab of the Preferences dialog box:

Use All Caps for Data Entry

When you select this preference, Payroll automatically capitalizes text on input fields in an open return. Open returns must be closed and re-opened for the change to take affect.

The following areas are not affected by the All Caps preference:

- Client Letters

- Preparer/ERO Information

- Company Information

- Insert Text on Form

- Preparer Notes

Refund Meter

This preference is enabled by default. When enabled, Payroll displays a Refund Meter that dynamically changes and displays the amount of the payment or refund due as you complete the Federal return. To disable this preference, clear the check box.

Auto-Save Returns

This preference is disabled by default. When enabled, Payroll will automatically save all open returns at regular intervals based on your selection. To enable this preference, select the check box and choose an interval (default is 5 minutes).

Returns that have already been e-filed or returns that have been marked Complete will not be saved.

Display Validation Errors

This preference is enabled by default. When enabled, Payroll automatically checks particular cells for proper data formatting. If the data is not entered into a particular cell correctly, an Entry Validation message is displayed with an explanation of the proper formatting for that cell. To disable this preference, clear the check box.

Show Form Tabs on Left

This preference is enabled by default. When enabled, form tabs appear to the left of the open form. When disabled, form tabs will appear above the open form. To disable this preference, clear the check box.

Display Tax Research Tool Tips

This preference is enabled by default. When enabled, Payroll displays Tax Research tool tips for Federal signature forms. To disable this preference, clear the check box.

Calculate W-2 Social Security and Medicare Wages

This preference is enabled by default. When enabled, Social Security (SS) and Medicare wages are automatically calculated based on wages entered in Box 1 of the W-2. To disable this preference, clear the check box.

Setting Check Return Filters

The Default Check Return Filters settings determine the type of messages displayed when you use the Check Return feature.

Payroll always checks for Errors. By default Warnings, Informational, Estimates, Notes, and E-file messages will also be displayed. The overrides option is disabled by default. To enable and have messages regarding overridden fields displayed also, select the Overrides check box. To disable any of these messages, clear the check boxes as desired.

Payroll does not allow you to disable Errors.

Disable Auto-Calculations on Detail Sheets

This preference is disabled by default. If enabled, auto-calculation will be temporarily disabled when you're working in a Detail sheet. When the Detail sheet is closed, the auto-calculation will run. To enable this preference, select the check box.

After making changes to Preferences, click Apply to save your changes and close the Preferences dialog box, or click OK to save your changes and leave the Preferences dialog box open.

See Also: